What is Google Finance?

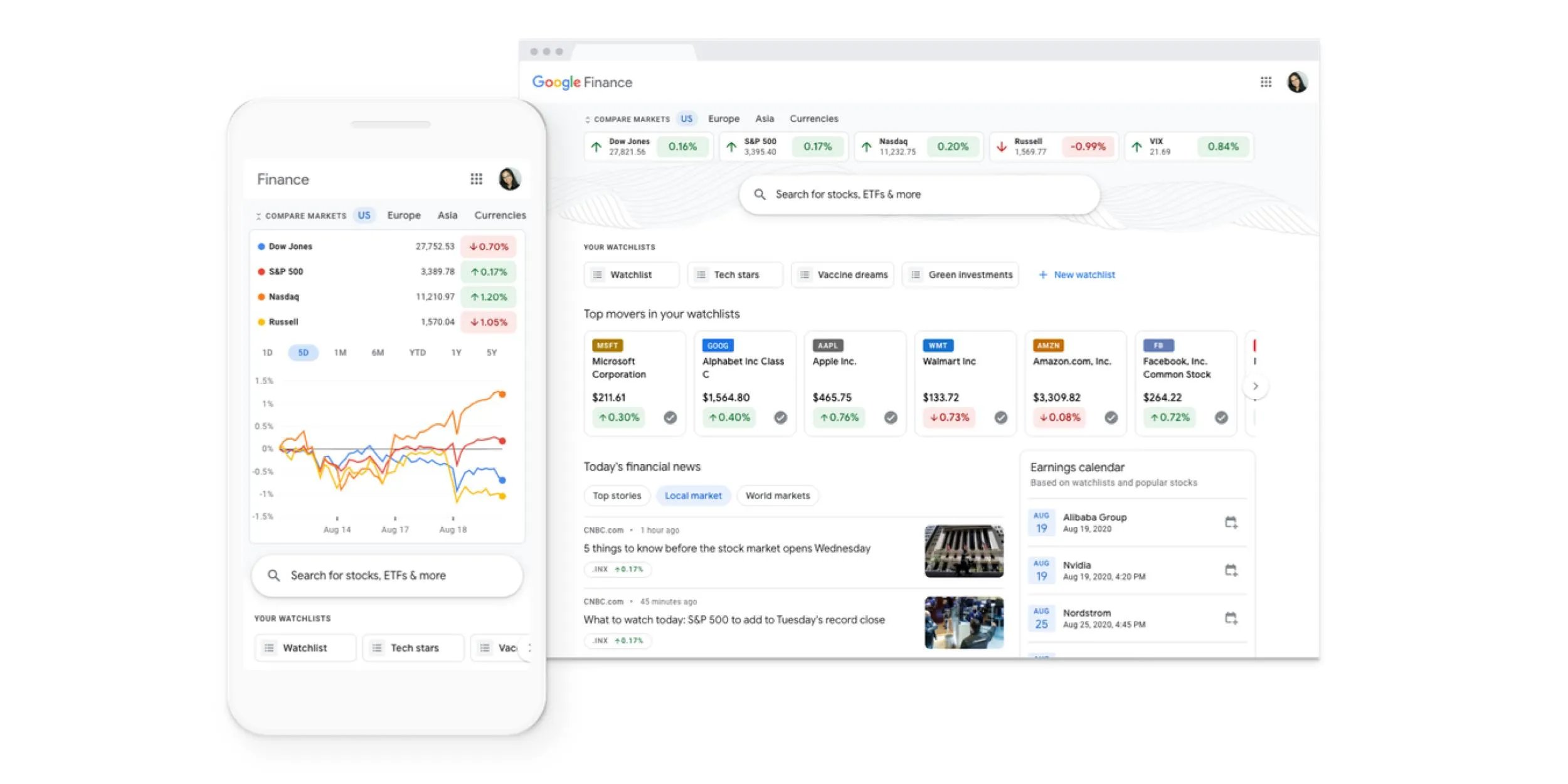

Google Finance is a free online platform provided by Google that offers comprehensive financial information, market data, and investment tools for individuals and businesses. It serves as a one-stop destination for tracking stocks, monitoring portfolios, and staying up-to-date with the latest financial news and market trends.

At its core, Google Finance aims to empower users with easy access to real-time stock quotes, historical data, and in-depth company profiles. It provides a user-friendly interface that displays stock prices, charts, and key financial metrics, allowing users to quickly assess the performance of their investments or potential opportunities.

One of the key features of Google Finance is its portfolio tracking capabilities. Users can create personalized watchlists and portfolios, enabling them to monitor their holdings, track gains and losses, and receive real-time updates on their investments. This feature is particularly useful for active investors who need to stay informed about their portfolio performance.

In addition to stock data, Google Finance also offers comprehensive financial news coverage from trusted sources. Users can access news articles, analysis, and commentary from reputable financial publications, helping them stay informed about market trends, company developments, and industry insights.

Overall, Google Finance aims to provide a user-friendly and accessible platform for investors, traders, and anyone interested in staying informed about the financial markets. With its wealth of data, tools, and resources, it empowers users to make informed investment decisions and stay on top of the ever-changing financial landscape.

History and Evolution

Google Finance was launched in 2006 as a free web-based application that provides real-time and historical stock market data, news, and analysis. Initially, it offered basic features like stock quotes, charts, and news headlines. Over the years, Google has continuously enhanced and expanded the capabilities of Google Finance to meet the evolving needs of investors and finance enthusiasts.

One of the significant updates came in 2008 when Google introduced the portfolio tracking feature, allowing users to monitor their investment portfolios and track their performance over time. This feature enabled users to import their holdings from various brokerages and stay updated with real-time market data.

In 2012, Google Finance underwent a major redesign, introducing a sleeker and more modern interface. The redesign also brought improvements to data visualization, making it easier for users to analyze stock charts and identify trends.

Over the years, Google Finance has continued to refine its features and introduce new tools to cater to the needs of different types of investors. For example, in 2018, Google added a screener tool that allows users to filter and search for stocks based on various criteria, such as market capitalization, industry, and financial ratios.

In recent years, Google has also focused on improving the mobile experience of Google Finance, ensuring that users can access financial information and tools on-the-go through their smartphones and tablets.

Overall, Google Finance has evolved from a basic stock quote and news platform to a comprehensive financial hub, offering a wide range of tools and features for investors, traders, and finance enthusiasts alike.

Using Google Finance

Google Finance provides a comprehensive platform for tracking stocks, managing portfolios, and staying up-to-date with market news and research. Here’s how to make the most of its features:

Stock Tracking

To track a specific stock, simply enter the company name or ticker symbol in the search bar. Google Finance will display the stock’s current price, daily price change, and a historical chart of its performance. You can customize the chart’s time frame, add technical indicators, and compare the stock’s performance against other securities or market indices.

Portfolio Management

Google Finance allows you to create and manage your investment portfolios. Add stocks, mutual funds, ETFs, and other securities to your portfolio by clicking the “Add to Portfolio” button on the stock’s page. You can track your portfolio’s overall performance, view your holdings’ allocation, and monitor your realized and unrealized gains/losses.

News and Research

Stay informed about the companies and industries you’re interested in by accessing the latest news and research directly from Google Finance. Each stock page includes a dedicated news section, displaying relevant articles from various sources. You can also find analyst ratings, earnings estimates, and financial statements for publicly traded companies.

Watchlists

Create customized watchlists to monitor a curated selection of stocks, ETFs, or other securities. Watchlists make it easy to keep track of your investments and potential opportunities without cluttering your main portfolio.

Alerts and Notifications

Set up price alerts to receive notifications when a stock hits a specific price target or experiences significant price movements. You can also enable email alerts for important news and events related to your holdings or watchlists.

Screeners and Filters

Use Google Finance’s powerful screeners and filters to find investment opportunities based on your specific criteria. Search for stocks based on factors like market capitalization, price-to-earnings ratio, dividend yield, and more.

With its user-friendly interface and robust features, Google Finance empowers investors to stay informed, make data-driven decisions, and effectively manage their portfolios.

Market Data and Information

Google Finance provides comprehensive market data and information covering a wide range of asset classes, including stocks, indices, currencies, and commodities. This robust financial platform offers real-time quotes, historical data, and in-depth analysis to help users make informed investment decisions.

When it comes to stocks, Google Finance covers major exchanges worldwide, providing up-to-the-minute quotes, charts, and key financial metrics for publicly traded companies. Users can easily access data on stock prices, trading volumes, market capitalization, price-to-earnings ratios, and more.

In addition to stocks, Google Finance offers extensive coverage of global indices, allowing users to track the performance of major market benchmarks such as the S&P 500, Dow Jones Industrial Average, NASDAQ Composite, and international indices like the FTSE 100, Nikkei 225, and Hang Seng Index.

For those interested in currency markets, Google Finance provides real-time exchange rates for major and minor currency pairs, enabling users to stay updated on fluctuations in the foreign exchange market. This feature is particularly useful for international traders, travelers, and businesses operating across multiple currencies.

Commodities, including precious metals, energy resources, and agricultural products, are also well-represented on Google Finance. Users can access up-to-date pricing information, historical charts, and news related to commodities such as gold, silver, crude oil, natural gas, and various agricultural commodities like wheat, corn, and soybeans.

Google Finance’s market data and information are sourced from reputable financial data providers, ensuring accuracy and reliability. The platform’s user-friendly interface and comprehensive coverage make it a valuable resource for investors, traders, and anyone seeking to stay informed about the latest market developments.

Portfolio Tracking and Management

Google Finance offers a robust portfolio tracking and management tool that allows users to monitor their investments in real-time. This feature enables investors to add stocks, mutual funds, ETFs, and other financial instruments to a personalized portfolio. Once added, users can track the performance of their holdings, including current prices, daily gains/losses, and overall portfolio value.

One of the key advantages of Google Finance’s portfolio tracking is its seamless integration with live market data. As stock prices fluctuate throughout the trading day, the portfolio values are automatically updated, providing investors with an up-to-the-minute view of their investments. This real-time tracking eliminates the need for manual calculations and ensures that investors have accurate and timely information at their fingertips.

In addition to tracking portfolio values, Google Finance also provides detailed performance analysis tools. Users can view charts and graphs that illustrate the historical performance of their holdings, allowing them to identify trends and make informed decisions. These analytical tools can be customized to display different time periods, ranging from intraday to multi-year timeframes, enabling investors to analyze their portfolios from various perspectives.

Another valuable feature of Google Finance’s portfolio tracking is the ability to set up watchlists. Investors can create customized lists of stocks, ETFs, or other securities they wish to monitor closely. These watchlists can be easily accessed and updated, ensuring that investors stay informed about the performance of potential investment opportunities.

Furthermore, Google Finance integrates news and research directly into the portfolio tracking experience. Users can access relevant news articles, analyst ratings, and research reports for the stocks in their portfolios, providing them with valuable insights and information to support their investment decisions.

News and Research Integration

Google Finance seamlessly integrates news, analysis, and research from reputable sources, providing investors with a comprehensive view of the companies and stocks they are tracking. This integration ensures that users have access to the latest developments, insights, and expert opinions, enabling them to make informed investment decisions.

The news section within Google Finance aggregates articles from trusted financial publications, news outlets, and industry experts. Users can quickly scan headlines and read summaries, with the option to access full articles directly from the platform. This centralized news hub eliminates the need to visit multiple websites, saving time and effort.

In addition to news, Google Finance offers in-depth research and analysis from financial analysts and industry experts. Users can access detailed company reports, earnings transcripts, and analyst ratings, providing valuable insights into a company’s financial performance, growth prospects, and competitive landscape.

Google Finance’s research integration extends beyond traditional sources. The platform also incorporates social media sentiment analysis, allowing users to gauge public opinion and sentiment towards specific companies or stocks. This feature can be particularly useful in identifying potential market trends or reactions to news events.

Furthermore, Google Finance provides access to financial blogs and discussion forums, enabling users to engage with other investors, share insights, and participate in discussions about specific stocks or investment strategies. This community aspect fosters a collaborative learning environment and allows users to benefit from the collective knowledge and experiences of fellow investors.

Overall, the seamless integration of news, analysis, and research within Google Finance empowers users with comprehensive and up-to-date information, enabling them to make more informed investment decisions and stay ahead of market trends.

Google Finance vs Competitors

Google Finance stands out in the crowded landscape of financial websites and tools by offering a user-friendly interface, seamless integration with other Google products, and a comprehensive range of features. While competitors like Yahoo Finance, Bloomberg, and others have their strengths, Google Finance distinguishes itself in several key areas.

One of the primary advantages of Google Finance is its simplicity and ease of use. The clean, minimalistic design allows users to quickly access the information they need without being overwhelmed by excessive clutter or complex layouts. This streamlined approach makes it an ideal choice for casual investors or those seeking a straightforward platform for tracking their portfolios and staying informed about market trends.

Another significant advantage of Google Finance is its deep integration with other Google products. Users can seamlessly access relevant news articles, analyst reports, and financial data directly within the platform, leveraging the power of Google’s search capabilities. Additionally, the ability to sync portfolios across devices and access information through Google’s suite of apps enhances the overall user experience.

While Bloomberg and other specialized financial platforms may offer more advanced tools and in-depth analysis for professional investors and traders, Google Finance strikes a balance between functionality and accessibility. Its user-friendly interface and intuitive navigation make it an attractive option for individual investors, small businesses, and those seeking a comprehensive yet approachable financial resource.

Overall, while competitors like Yahoo Finance, Bloomberg, and others have their strengths, Google Finance distinguishes itself through its simplicity, seamless integration with Google’s ecosystem, reliable data sources, and a well-rounded feature set tailored to meet the needs of individual investors and casual users alike.

Mobile Apps and Accessibility

Google Finance offers dedicated mobile apps for both iOS and Android platforms, allowing users to access financial information and manage their portfolios on the go. The mobile apps are designed to provide a seamless and user-friendly experience, ensuring that investors can stay up-to-date with the latest market movements and make informed decisions regardless of their location.

The Google Finance mobile apps offer a range of features similar to the web-based platform, including real-time stock quotes, interactive charts, news and analysis, portfolio tracking, and watchlists. Users can easily customize the app’s layout and content to suit their preferences, ensuring that the most relevant information is readily available.

One of the key advantages of the Google Finance mobile apps is their cross-device accessibility. Users can seamlessly switch between their desktop or laptop computers and mobile devices, ensuring that their portfolio data, watchlists, and preferences are synchronized across all platforms. This level of integration allows for a consistent and cohesive experience, enabling users to pick up where they left off, regardless of the device they are using.

Furthermore, Google Finance’s mobile apps are designed with accessibility in mind, ensuring that users with disabilities or special needs can easily navigate and interact with the platform. Features such as adjustable font sizes, high-contrast modes, and support for screen readers cater to a wide range of user requirements, making financial information accessible to everyone.

Overall, the Google Finance mobile apps and their cross-device accessibility ensure that investors can stay connected to the financial markets and manage their portfolios seamlessly, regardless of their location or the device they are using. This level of mobility and accessibility empowers users to make informed decisions and stay ahead in the ever-changing financial landscape.

Integration with Other Google Products

Google Finance seamlessly integrates with various other Google products, enhancing its functionality and providing users with a comprehensive financial management experience. One of the key integrations is with Gmail, allowing users to receive real-time updates and alerts about their portfolio directly in their inbox. This feature ensures that investors stay informed about significant market movements or changes in their holdings without having to constantly monitor the platform.

Another powerful integration is with Google Sheets, enabling users to import their portfolio data and perform advanced analysis using the spreadsheet’s powerful tools. This integration empowers investors to create customized financial models, perform calculations, and visualize their data through charts and graphs, facilitating better-informed decision-making.

Google Finance also integrates with Google Search, providing users with quick access to financial information directly from the search results. By simply searching for a company’s name or stock ticker, users can instantly view key financial data, news, and charts without having to navigate to the dedicated Google Finance platform.

Furthermore, Google Finance integrates with Google Calendar, allowing users to schedule important financial events, such as earnings reports, investor conferences, or dividend payment dates. This integration helps investors stay organized and never miss crucial financial events that could impact their investments.

Overall, the seamless integration of Google Finance with other Google products creates a cohesive and powerful financial management ecosystem. By leveraging the strengths of each product, users can streamline their investment processes, stay informed, and make data-driven decisions with ease.

Data Sources and Reliability

Google Finance sources its data from various reliable providers, including major stock exchanges, financial data firms, and reputable news outlets. The platform aggregates real-time and historical data from these sources to provide users with comprehensive and up-to-date information.

One of the primary data sources for Google Finance is the stock exchanges themselves, such as the New York Stock Exchange (NYSE), NASDAQ, and other global exchanges. These exchanges provide real-time quotes, trade data, and other essential market information, ensuring that users have access to accurate and timely stock prices.

In addition to stock exchanges, Google Finance also relies on financial data providers like Bloomberg, Reuters, and Morningstar. These companies specialize in collecting, processing, and distributing financial data, including company fundamentals, analyst ratings, and detailed financial statements.

To complement the market data, Google Finance integrates news from trusted sources like The Wall Street Journal, Reuters, and Bloomberg. This news integration allows users to stay informed about the latest developments, events, and analysis that may impact their investments.

Google Finance employs robust data validation processes to ensure the accuracy and reliability of the information presented on its platform. This includes cross-referencing data from multiple sources, applying data cleansing techniques, and implementing quality control measures.

Furthermore, Google Finance actively monitors the data feeds and promptly addresses any discrepancies or anomalies that may arise. This commitment to data integrity and reliability is crucial for users who rely on the platform for making informed investment decisions.

While no data source is perfect, Google Finance’s approach to sourcing data from reputable providers and implementing rigorous data validation processes helps to ensure a high level of accuracy and reliability for the information presented on the platform.

Advanced Tools and Features

Google Finance offers a suite of advanced tools and features to empower investors and traders with comprehensive data analysis and decision-making capabilities. One of the standout offerings is the powerful charting platform, which allows users to visualize financial data in various formats, including line charts, candlestick charts, and interactive price charts.

This charting tool is highly customizable, enabling users to overlay multiple technical indicators, drawing tools, and comparative data sets on the same chart. Investors can analyze historical price movements, identify patterns, and make informed trading decisions based on their analysis.

Additionally, Google Finance provides robust screening capabilities, allowing users to filter through thousands of stocks, ETFs, and other financial instruments based on specific criteria such as market capitalization, industry, price-to-earnings ratio, and dividend yield. This feature is particularly useful for investors seeking to identify potential investment opportunities that align with their investment strategies and risk profiles.

Another advanced feature is the portfolio analysis tool, which enables users to track the performance of their investment portfolios, monitor asset allocation, and evaluate risk exposure. This tool provides valuable insights into portfolio diversification, potential tax implications, and overall investment performance, empowering investors to make data-driven decisions regarding their investment strategies.

Furthermore, Google Finance integrates with various third-party data providers, ensuring access to accurate and up-to-date financial information. This integration allows users to access comprehensive company profiles, financial statements, analyst ratings, and insider trading data, all within the Google Finance platform.

Overall, Google Finance’s advanced tools and features cater to both novice and experienced investors, providing a comprehensive and user-friendly platform for financial analysis, portfolio management, and informed decision-making.

Google Finance for Businesses

Google Finance is a powerful tool that businesses can leverage for research, insights, and data-driven decision-making. By providing access to real-time market data, news, and analysis, Google Finance empowers businesses to stay informed and make strategic decisions based on accurate and up-to-date information.

One of the key benefits of Google Finance for businesses is its ability to track specific stocks, industries, or markets relevant to their operations. Businesses can create customized portfolios and watchlists, allowing them to monitor their investments, competitors, and industry trends with ease. This feature is particularly valuable for businesses operating in dynamic and fast-paced markets, where staying ahead of the curve is crucial.

Furthermore, Google Finance provides access to historical data and charting tools, allowing businesses to conduct in-depth analysis and identify patterns or trends over time. This feature is particularly useful for businesses engaged in financial modeling, forecasting, or investment strategies.

Businesses can also leverage Google Finance’s integration with other Google products, such as Google Sheets and Google Data Studio, to create customized reports, dashboards, and visualizations. This seamless integration enables businesses to analyze and present financial data in a clear and compelling manner, facilitating data-driven decision-making processes.

Moreover, Google Finance offers advanced tools and features tailored to businesses, such as financial calculators, currency converters, and stock screeners. These tools can assist businesses in conducting financial analysis, evaluating investment opportunities, and making informed decisions based on quantitative data.

Overall, Google Finance is a valuable resource for businesses seeking to stay informed, conduct research, and gain insights into financial markets, industries, and competitors. By leveraging the wealth of data, news, and analysis available on Google Finance, businesses can make more informed and data-driven decisions, ultimately driving their success and growth.

The Future of Google Finance

Google Finance has come a long way since its inception, and it continues to evolve to meet the ever-changing needs of investors and financial enthusiasts. As technology advances and user preferences shift, several potential developments could shape the future of this powerful financial platform.

One area of potential growth is the integration of artificial intelligence (AI) and machine learning (ML) capabilities. Google Finance could leverage these technologies to provide more personalized and intelligent insights, such as predictive analytics, automated portfolio optimization, and real-time market trend analysis. By harnessing the power of AI and ML, users could gain a deeper understanding of market dynamics and make more informed investment decisions.

Another potential development is the expansion of social features and community engagement. Google Finance could introduce features that allow users to connect with like-minded investors, share insights, and participate in discussions. This could foster a vibrant community of financial enthusiasts, enabling users to learn from each other’s experiences and gain valuable perspectives.

Furthermore, the increasing demand for sustainable and socially responsible investing could influence the future of Google Finance. The platform could incorporate environmental, social, and governance (ESG) data and metrics, enabling users to align their investments with their values and ethical principles. This would cater to the growing interest in impact investing and promote transparency in corporate sustainability practices.

Google Finance could also explore the integration of virtual and augmented reality (VR/AR) technologies to enhance the user experience. Imagine being able to visualize financial data in 3D or immerse yourself in a virtual trading floor, providing a more engaging and interactive way to consume financial information.